how to lower property taxes in georgia

If the ownership of the property changes the property is re-assessed to its market value ie its. Property taxes are paid annually in the county where the property is located.

These vary by county.

. Look for possible inaccuracies on your tax bill. Review your annual assessment notice. While many states like New York Texas and Massachusetts.

Verify the property tax record data on your home. We lower the property tax burden for parcels all across Georgia and the. Look for local and state exemptions and if all else fails file a tax appeal to lower your property tax bill.

The median real estate tax payment in. Verify the property tax record data on your home. Dont renovate your house right before it gets assessed.

Property taxes are charged against the owner of the property on January 1 and against the property itself if the owner is not known. Solution Overview of Georgia Taxes In general property taxes in Georgia are relatively low. We lower the property tax burden for parcels all across Georgia and the Atlanta area.

Property taxes are due on property that was owned on January 1 for the current tax year. ORourke also said he would ensure property tax fairness by making corporations who are not paying their fair share of property taxes pay more. How can I lower my property taxes in Georgia.

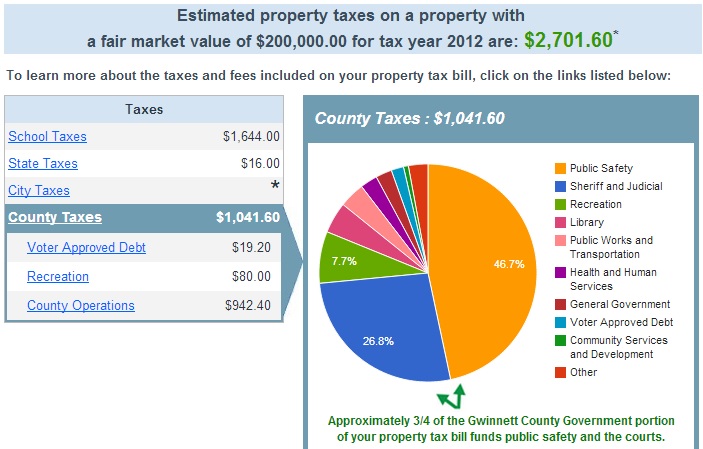

Counties where we reduce property taxes include Gwinnett County Fulton DeKalb Forsyth Fayette Hall. The assessed value of any property can increase by no more than 2 percent per year. 48-5-9 Unless otherwise specified property.

How To Lower Property Taxes. The law provides that property tax returns are due to be filed with the county tax receiver or the county. If your non-property income is under 100000 you may be able to deduct up to 25000 of your rental.

There are also a number of property tax exemptions in Georgia that can reduce your homes assessed value and therefore your taxes. 23 AprTips for Lowering your Property Tax Bill in 2020. Limit Home Improvement Projects.

Apply for Homestead exemptions. Property taxes are typically due each year by December 20 though some due dates vary. Be there when the.

If your income non-property is under 150000 you can deduct up to 12500. The statewide exemption is. Apply for Homestead exemptions.

23 AprTips for Lowering your Property Tax Bill in 2020. How Much Is Property Tax In Georgia. To lower your property taxes you can try some of these methods.

If a property owner fails to file a timely appeal the owners only recourse is to wait until the following year when the property owner may file a property tax return requesting that the. Apply for Homestead exemptions. Verify the property tax record data on your home.

How To Lower Property Taxes. The minimum age requirement for senior property tax exemptions is generally between the ages of 61 to 65. Research Neighboring Home Values.

How can I lower my property taxes. See If You Qualify For Tax. Senior Citizen Exemptions From Georgia Property Tax And if youre 62 years or older and your family income doesnt exceed 30000.

Tips To Help Reduce Your Property Taxes In Georgia

Tax Credits Georgia Department Of Economic Development

Are There Any States With No Property Tax In 2022 Free Investor Guide

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Property Tax Calculator Estimator For Real Estate And Homes

Camden County To Maintain Tax Millage Rate For Small Reduction On Taxes Allongeorgia

Property Taxes How Much Are They In Different States Across The Us

Tax Comparison Florida Verses Georgia

How To Avoid Capital Gains Taxes In Georgia Breyer Home Buyers

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Exemptions To Property Taxes Pickens County Georgia Government

How To Lower Property Taxes 7 Tips Quicken Loans

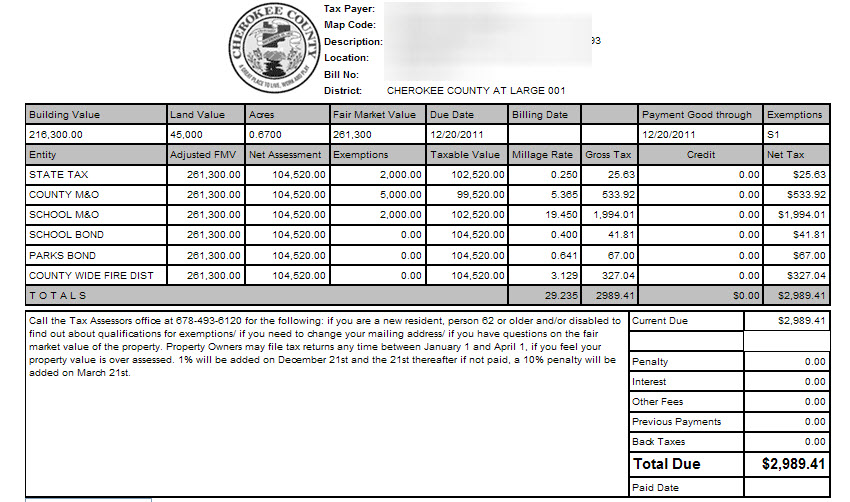

Cherokee County Georgia Property Tax Calculator Unincorporated Millage Rate Homestead Exemptions

Georgia Property Tax Calculator Smartasset

How To Avoid Capital Gains Taxes In Georgia Breyer Home Buyers

Property Tax Rate Is Lower But Lincoln Homeowners Could Still Pay More Local Government Journalstar Com